Table of Content

What is the best way we can get the apartment by using our pag ibig loan.. Gud am… I am a first time to apply for a housing loan. Please provide me the steps on how to apply for a housing loan. Yes, you are definitely qualified for a loan.

First, Pag IBIG is a public institution that provides wages and housing loans to its members. It is currently the only public institution that services home loans for all its members, while banks can be shared or semi-public. Government, but mostly a private company that caters to various types of loans to all qualified applicants after applying and going through the credit investigation process.

Submit All Housing Loan Requirements to Pag IBIG

When it comes to interest rates, banks offer low-interest rates with a fixed rate for 1-, 2-, 3-, and 5-year loans . Conversely, PAG-IBIG has a fixed pricing period of up to 30 years. The member has no outstanding Pag-IBIG multi-purpose loan in arrears at the time of the loan application. A lot of Filipinos dream of owning their first apartment or house and lot. With today's booming real estate opportunities, there are so many options to choose from. If in the future you find that you need to renegotiate your housing loan terms, you can apply for a loan restructuring at Pag-IBIG’s Special Housing Loan Restructuring Program page.

The most important factors are your income, your contributions and the amount of loan. If you are currently paying in BDO, then those documents are already in the bank. You need to arrange this with BDO if they will allow your plans.

Can I Get An Emergency Loan With Bad Credit

Pag-IBIG Fund loan calculator online in the Philippines in 2022. A handy tool that will show whether you can pay off a loan, help you choose lending with affordable payments. If you have an outstanding Pag-IBIG loan, you may not be eligible for a housing loan from the Fund. Pay off your overdue loan payments before submitting an HLA.

This comprises all sources of income, not only labour, and is not limited to monetary earnings; it can also include property or services gained. Gross income is equivalent to gross margin or gross profit in the business world. As reported on the income statement, a corporation's gross income is the money from all sources less the firm's expenditures for items sold . The gross income is requested on a monthly basis in the Pag-IBIG loan calculator. It isn't easy to assess the exact cost of your monthly payments with the different interest rates.

What Can You Purchase With Your Borrowed Money From Pag

Hoping for this will be answered,.,thank you.. That’s possible as long as the documents are ready. You may coordinate with the developer on this one. The reason is that, it is one of way of checking if the loan is really used for the construction. If you want to avail of another Pag-IBIG Housing Loan, you need to pay the previous loan in full first.

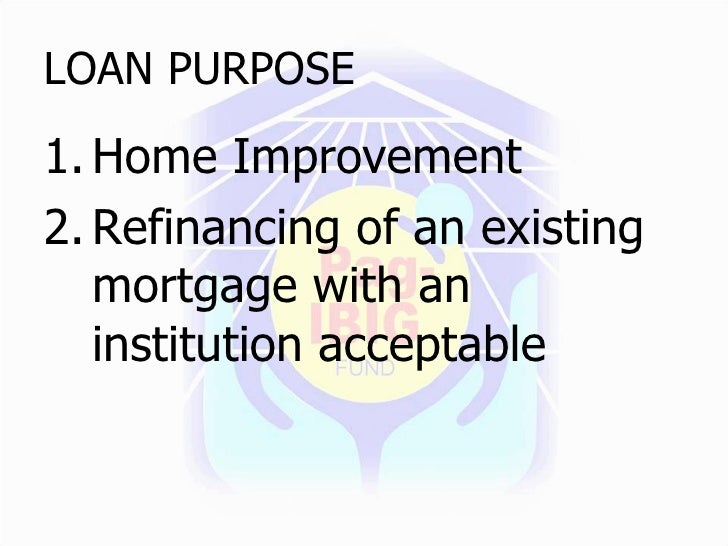

You are only allowed on Housing Loan at a time. You have to pay this one first before you can apply again for another Housing Loan. Regarding my concern if i am allowed for the construction house loan i just want to loan for 200,000.00 only for the renovation and for the house improvement only.

Pag-IBIG Fund’s Home Improvement Loan

Have no defaulted Pag IBIG accounts on the application date. Payments via an accredited developer with a collection service agreement from the Pag IBIG agency. My loanable amount is 80% of P20,000 which is P16,000. Then, I have an existing Calamity Loan Balance, lets say, P3,000, my loanable amount would be P16,000 minus P3,000 and this is equal P13,000.

Apart from the general eligibility and requirements, the documents needed depends on the purpose of your housing loan. Complete the specific checklist that applies to your purpose. Disclaimer - the information which is presented on Advanceloans.ph is provided for informative purposes only; all rates are subject to change based on only your personal circumstances. As with the Pag-IBIG Fund Multi-Purpose Loan Application, not everyone can complete the Multi-Purpose Loan Application Form and take advantage of the program.

Contact the Pag-IBIG customer service representatives for further information and guidance on housing loans. Principal and interest.The principal and interest payment on a mortgage is most likely the bulk of your monthly mortgage payment. The principal is the amount you borrowed and must repay, while interest is the fee charged by Pag-IBIG for lending you the money. And would this hinder me for applying housing loan?

These loans were used when we started have our house constructed last May. Our house construction was stopped as we lack cash.We are now planning to file for a house construction but the lot title is under my name. Is it okay if my husband who is also an employed pag-ibig member will be the one to apply for the house construction? I am worried that my bank loans may cause a denied application although all of my loans are updated although both of us are earning above average. Please note that my husband and I both have an updated multi-purpose loan which can also be seen in our payslips. Kindly advise our chances and the best way to do.

The interest rate of your loan starts at 6.25% with a fixing period of a minimum of one year up to 20 years, depending on your loan amount. In this program, which is conducted several times a year in specific Pag IBIG branches and venues, you can address your concerns directly to the Pag IBIG personnel. Proceed to the Registry of Deeds for the transfer of the title and annotation of the mortgage. The complete NOA requirements must be submitted within 90 days, or else you won’t get the check and will receive a Notice of Deficiency instead. If your application is approved, expect a call from Pag IBIG informing you when you can pick up the Notice of Approval and Letter of Guaranty .

Please bear in mind that this will be another expense and will take a toll on your family budget. It is best to include both incomes so you have a greater chance of approval especially if you are applying for a larger loan amount. If your income is sufficient, then that should be fine. No, the existing housing loan has to be fully paid first. Comply the requirements for lot purchase and for lot construction. Is one of the fastest-growing online publishing platforms in the financial & business space in the Philippines.

Get all your documents in order

If you have no records there, you can simply apply as a new member. You may have to consolidate your contributions first and then apply for a housing loan. They may have to ask for an updated document any time after about 6 months of the application process.

No comments:

Post a Comment